The Most Appropriate Investing Style for You

“Be fearful when others are greedy; be greedy when others are fearful.”

The above quote is attributed to “The Oracle of Omaha,” Warren Buffett. The last 10 years have been good for stock investors, with the S&P 500 Index up almost 250%. This historic bull market has favored the aggressive investor. A long period of steady growth has a tendency to make people both complacent and ever more aggressive, even if unintentionally, in their investments. However, there is an old saying on Wall Street that “trees do not grow to the sky.” At some point the party ends and the overly aggressive investor finds himself looking at serious losses.

If we go back to the last bear market, from October 2007 until March 2009, the U.S. stock market lost over 50%. That was immediately followed by the extraordinary bull market run that we are currently experiencing.

The aggressive investor who held the S&P 500 ETF or mutual fund lost half his money during the crisis and needed to more than double it just to break even! Assuming he stayed the course and didn’t sell-off in a panic, it would have taken over four years just to earn back what he lost.

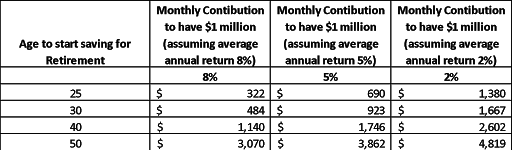

While aggressive investing may be appropriate for younger investors who have decades ahead of them to recover from financial panics, it’s not recommended for people approaching – or in – retirement. To lose half of your hard-earned nest egg, designed to provide for a comfortable lifestyle in retirement, would be financially and emotionally devastating.

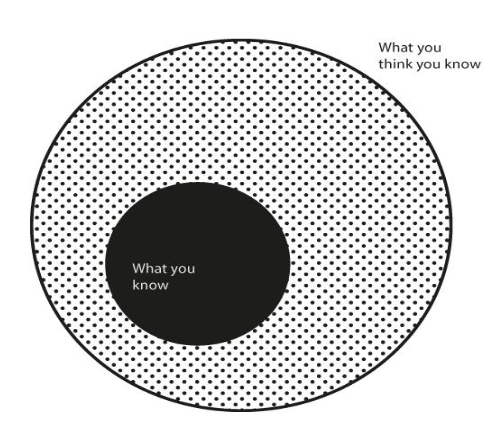

What is the appropriate investing style for you? Do you consider yourself aggressive or cautious? Have you ever really looked at your portfolio and done any sort of analysis to see if it is truly as aggressive or conservative as you think it is? If you haven’t, or if you have concerns that your portfolio may be at risk during the next recession, it’s worth your time to talk with a professional investment advisor. We can review your portfolio and your goals with you and provide recommendations and guidance to ensure that you are where you need to be with your investments.