Pay off your debt

Consumer debt is expected to reach a record $4 trillion by the end of 2018. The average family is spending about 10% of their monthly income paying for auto loans, credit cards, student loans and personal debt; and this does not include mortgage payments! The wisest financial decision you can make in 2019 is to rid yourself of as much debt as possible.

Getting out from under debt payments is like getting a raise, but it’s even better. You have to pay taxes on a raise, but eliminating debt falls right to the bottom line: it’s 100% yours!

It’s worth noting that the first thing that Bill Gates, the founder of Microsoft and one of the world’s richest people, did when he made his first million was to pay off his $150,000 mortgage.

Eliminating debt, and that includes a mortgage, as quickly as possible means that it’s much easier to overcome life’s unpredictable adversities. If you have an accident, become ill, lose your job or incur other unexpected expenses and are in debt, your problems multiply. Your once-manageable debts are suddenly going to become not-so-manageable and losing your car or your home – or even bankruptcy – becomes a possibility.

Debt reduction is critically important because it affects most of your other financial priorities. It reduces your basic living expenses while it provides the means for the second most important financial decision you make in 2019: saving.

Increase your savings

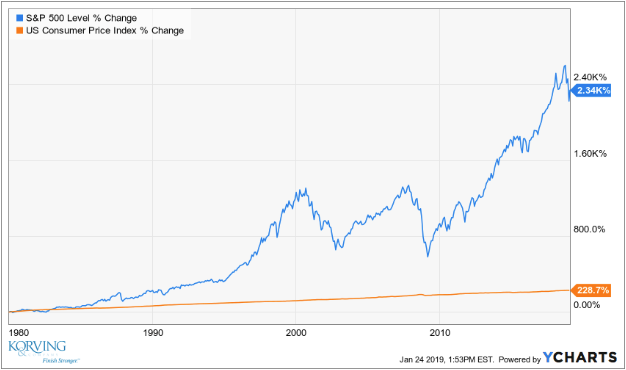

Captain Obvious here: Your savings rate has a huge impact on your financial future. The first reason is that the higher your savings rate, the more you are insulated from interest rates and the volatility of the market.

It makes sense that if your savings rate is low you will have to reach for a higher rate of return to reach your goal. Aggressive investing increases the risk of major losses, which leads to a higher probability of failing to reach your financial goals.

Increasing your savings rate allows you to plan for earlier retirement. While we can’t tell you the best savings rate for your situation without a formal financial plan, a rule of thumb is that a savings rate of 20-25% will get you to your financial goals sooner and with less risk of failure.

Another benefit from saving more is that you will accustom yourself to living below your means. Spending every dollar that you earn is a hard habit to break.

What makes saving so difficult is that we live in a consumer-driven economy which bombards us with sales messages that are hard to resist. Those big screen TVs keep getting bigger and better each year. Smart phones are getting smarter and car dealers are offering incentives to get us into their showrooms. The best way to save is to always pay yourself first. If you can put 20 – 25% of your take-home pay into savings for your retirement you will have taken a huge step toward financial security.

Over time, you will find that your investment income will gradually grow until it becomes larger than your savings rate.

This leads to another important point about saving: start as early as possible. Giving your money as much time as possible to grow makes a huge difference in where you end up financially.

For example, let’s assume you save $10,000 per year from age 25 to 40 and then – for whatever reason — stop saving. Your contributions will total $150,000. At age 65 your account will have grown to over $1,058,912 million (assuming a 6% annual return).

Your neighbor delays for a decade and decides to begin saving $10,000 at age 35 and continues to age 65. After saving for 30 years he will have contributed $300,000, but his account will only be worth only $838,019 (again assuming a 6% annual return).

That’s a big difference of over $220,000 and it’s all due to the power of time and compounding!

Thanks to the skyrocketing cost of higher education, an unfortunate side-effect of student debt is that it prevents too many recent college graduates from starting a savings and investment program. If you are in that situation or know of someone who is, get the advice of a good financial advisor. Time is of the essence.

Review your investments

Your life changes and so does the world around you. You should review your investments at least once a year to make sure they are aligned with your needs and objectives.

Begin by analyzing your personal situation. Identify key milestones or events that have happened in the last year. Has your family changed, and if so, what does that mean for your financial objectives? Has your career path changed, and what does that mean for your ability to save and your financial security? Are you nearing retirement, and do you know what your income, assets, liabilities and expenses are?

Just as your personal life is evolving over time, the financial world around you is constantly changing. Look over your portfolio:

- Is it aligned with your goals and strategies?

- Is it meeting your performance objectives?

- What is your portfolio’s risk level? How comfortable are you with this amount of risk?

- Is your portfolio too concentrated in one particular stock or sector?

- Is your portfolio’s composition part of a coherent strategy or is it really just a haphazard collection cobbled together over time?

- Evaluate each portfolio component and ask yourself if you would still buy it today.

There is a tendency for investors to “set it and forget it.” Over the last 2 decades we have experienced several severe financial shocks. Major banks and investment firms have gone out of business and their stock and bond holders have lost everything. Household names — some of whom have been around for a century — like General Motors, Chrysler, Delta Airlines, Sears and General Electric, have either gone bankrupt or lost most of their value.

Newcomers like Amazon, Apple, Facebook and Google/Alphabet have become financial giants. But there is an old Wall Street saying, “trees don’t grow to the sky.” If you are fortunate enough to have invested in these companies, review your holdings and if any of them become too big a percentage of your investment portfolio either individually or collectively, trim them back to a safe level. Too often, high growth companies turn into “torpedo” stocks – ones that can sink your investment plan if their share prices plummet.

Make a plan

Here’s some good news: you can positively affect your level of economic success by planning for your future instead of winging it. Without a goal, and a plan to get there, people can spend years chasing short-term objectives while their long-term objectives get farther away.

Most of the people who have come to us for a financial plan are getting very close to retirement. They want to know:

- If they can retire,

- When they can retire and

- If they can live in the style to which they are accustomed.

But waiting until retirement is just around the corner leaves little time to make corrections. The ideal time to create a financial plan is when you’re young.

A financial plan is like a roadmap. It’s a map in time instead of space. Like a road trip, there are places you want to stop along the way, and an ultimate destination you want to reach. The stops along the way may be marriage, a home, college for the kids, cars, vacations or starting your own business. The destination may be retirement or leaving a legacy.

Along the route there are hazards to contend with: financial risks, illness, disability or even death.

Financial planning forces you to focus on the things you can control – like earning and saving — and understand that part of the future is outside of your control. It can point out ways to protect your goals against risks that are outside your control.

A plan will identify resources you will need to reach your objectives, including the professional advisors who will help you with the legal issues and determine who will provide the financial guidance you will require. A good plan can even help guide your beneficiaries and heirs once you are gone.

A plan does not execute itself. Like a map, you need to check it from time to time to make sure you are on the right road.

And, if you make the wrong turn and get lost, you need to be able to stop and ask directions. This is where a financial planner, the one who helped you create your plan in the first place, is the right person to ask.

Involve your family

One of the most common mistakes people make is keeping their spouse or significant other in the dark about the family investments. We have helped quite a number of widows whose husbands did not involve them in the family finances. This is unfortunate for many reasons.

Now is a good time to go over the family finances with your spouse or significant other so that if they find themselves “suddenly single,” they will not be both grief-stricken and concerned about how they will live.

If your spouse or significant other has a severe disinterest in finances and investing, now is the time for you to seek out a trusted financial advisor together, a fiduciary who will be able and willing to review and explain your investments from a professional perspective. Creating a professionally-managed investment portfolio that will outlive you and take care of the loved ones you leave behind may be one of the best decisions you can make in the new year!