Warren Buffet and The Circle of Competence

Warren Buffett is known as “The Oracle of Omaha” and for being the third richest man in America because he knows his circle of competence. He made his fortune by using his ability to identify great companies and investing in them. Here is a piece of advice he provided in a 1996 shareholder letter:

“What an investor needs is the ability to correctly evaluate selected businesses. Note the word “selected.” You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.”

Warren Buffet On The Circle Of Competence

Warren Buffett recently used the phrase circle of competence to explain why he didn’t invest in Amazon despite having known the founder, Jeff Bezos for 20 years. Evaluating the Amazon business model – and its start as an online book store – was outside his circle of competence.

So what does this legendary investor do when he realizes that there are investment opportunities outside of his area of expertise? He doesn’t venture into areas in which he is not an expert. He does what other smart people do. He hires people whose competence supplements his own. Charlie Munger, Warren Buffett’s partner explains it this way:

“You have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don’t, you’re going to lose. And that’s as close to certain as any prediction that you can make. You have to figure out where you’ve got an edge. And you’ve got to play within your own circle of competence.”

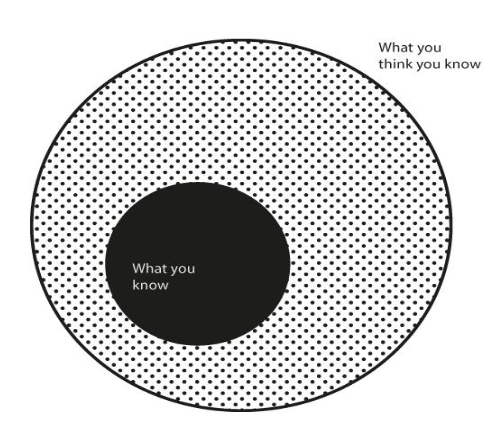

The problem most people have is that there is a big difference between what they think they know and what they know.

It’s a problem that gets so many people into trouble. They think they know more than they do. In fact, many believe they can predict the future and, in turn, the market’s ups and downs. Because no one really has a working crystal ball, it’s one reason why the typical investor does so much worse than the market.

Conclusion

If you’re an engineer, a doctor, a business owner, or an executive you will improve your odds of success in life if you operate inside your circle of competence. If you’re not a professional investor, investing is not in your circle of competence. We can provide that competence. We know what our circle of competence is and, like Warren Buffet, we stay within it. That’s how we help our clients succeed in life.

Use our contact page or call 757-638-5490 for more questions.

Written By ARIE J. KORVING, CFP®

Arie J. Korving, a CERTIFIED FINANCIAL PLANNER™ professional, has been delivering customized wealth management solutions to his clients for more than three decades. Prior to co-founding Korving & Company, he was First Vice President with UBS Wealth Management and held management positions with General Electric.

Contact Us

Newsletter Signup

"*" indicates required fields

© Korving & Company, LLC