The Successful Investor’s Perspective: All About Timing?

After December’s market plunge and January’s surge, we can forgive investors for feeling whiplash. During times of extreme volatility, it is especially common for investors to conclude, whether on a conscious or unconscious level, that the market is not for them. For that reason, it is worth reflecting on the market over a working lifetime.

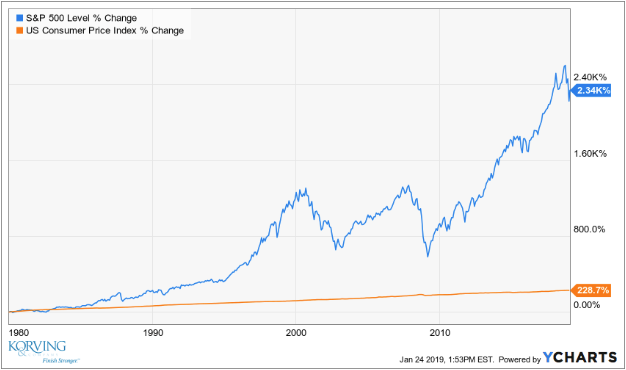

The chart below depicts 40 years of market returns and the consumer price index (CPI). Over the long run, Certificate of Deposit (CD) rates return about 2% over inflation, so we used the CPI as a proxy.

I chose 40 years because it typifies the time period most people earn income through their work.

Over that length of time, whether you’re looking at stock funds whose graphs are moving upward or have your money in a CD whose value grows almost horizontally, you must ask yourself which line is right for you.

If you choose the orange level line with little fluctuation you need to know that the money you will have to finance your retirement is almost totally dependent on how much you can save. This is because the internal growth will be very low.

Choosing the blue line, realizing it’s more jagged, says that you want your money to work as hard for you as you work for it. As you reach a certain point in your career you may find that your investments are actually earning more money than you’re getting paid from employment.

The process of investing involves high points and low points. The view from the peaks is magnificent while the terror of the slide into the valley can be traumatic. But when you look back, having arrived at the destination of financial independence, the oscillation that had caused so much grief can be plotted as a straight upward line between two points. It’s not easy negotiating that perilous ascent, but it may help knowing that in the end it really will smooth out if you stick with it.

Some people can take this financial journey by themselves. Many others need guidance on how to invest and the psychological support they need in order to stay the course when fear takes over.

The principals at Korving & Company have been doing this for over 30 years. We invite you to find out how we can help you.