The Benefits of a Modern Retirement Plan

If you are like most people approaching retirement, you are probably wondering if you’re financially ready. You may have a pension. You plan on collecting social security. You may have put money into your employer’s 401k plan. You and your spouse may each have an IRA and some money in the bank. You may have some life insurance or an annuity or a long-term care policy.

Does that mean you can retire when you want? The answer is: it depends.

There are lots of things that can happen in the 20 to 40 years you will be retired. Here are a few things that may cause you to ask questions.

Question #1: Is your Social Security safe?

The Social Security trust fund is currently projected to be able to pay full benefits until 2035. How will it affect you if the funds run out? A retirement plan should answer that question.

Question #2: Is your pension safe?

Company and public employee pensions are underfunded. What happens if your company, city, or state goes bankrupt? It could happen.

Question #3: How long will your retirement savings last?

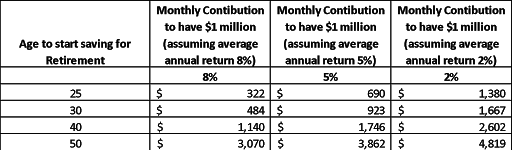

You may be planning on your investments continuing to grow at the rate they have in the past, but what if they don’t?

Question #4: How risky are the investments in your portfolio?

Many people have been lulled into believing that all they need to do is put their money into a low-cost index fund. The index lost nearly 50% in 2009 and 34% in March 2020. If you’re still investing in stock index funds as you near retirement just because they’re “cheap,” you may be taking on way more risk than you realize.

Question #5: How much will it cost if you or your spouse need to go into a nursing home?

Long-term care insurance may pay for it, but the insurance is not free. For some people buying a policy makes sense, while for others it might not. A financial plan can help answer whether a long-term care policy is right for you.

Question #6: What happens if inflation comes roaring back?

Living on a fixed income after you retire makes inflation a much bigger threat than when you were working.

Question #7: How does living too long or dying too soon affect your retirement plan?

Critical decisions are often made during the retirement process without enough consideration of how long you will live. While a plan can’t answer how long you’ll live, it can project how your plan will be altered if you live longer or shorter than you think.

In the past, retirement planning was a static process. Planners took the information supplied by their clients and provided a book of charts and graphs designed to show their financial condition for decades in the future. The technology limited what you could do.

New computer programs allow Financial Planners to run thousands of tests to analyze a number of different scenarios. The new planning process also allows people to check, update, and re-review their plans as time passes and conditions change. These programs allow scenarios to be run in real-time and can be generated for a modest cost by Certified Financial Planners™ (CFP®s) who specialize in retirement planning.